Almost 80% of Global Hotel Investors Intent on Buying Hotels This Year Say JLL Survey

Date: October 2022

Location: Global

What Did They Say: Hotels in the US are the most sought-after, with 24% of respondents targeting hotels there, followed by Southeast Asia (22%), global (22%), Europe (12%), Northern Asia (12%) and rest of the world (8%), according to the survey

Who They: JLL’s Global Hotel Investor Sentiment Survey published last week

Main photo: The Renaissance Vienna, one of the 15 hotels acquired by Borealis referred to in the report

Almost 80% of hotel investors globally are intent on buying hotels this year, according to JLL’s Global Hotel Investor Sentiment Survey published last week.

Investors expressed an increased appetite for hospitality as fundamentals continue to improve, with 20% of investors indicating they will deploy from $501 million (€515 million) to over $1 billion of capital into the hospitality sector, up from just 7% last year and 16% in 2020, marking the highest level since the pandemic.

Hotels in the US are the most sought-after, with 24% of respondents targeting hotels there, followed by Southeast Asia (22%), global (22%), Europe (12%), Northern Asia (12%) and rest of the world (8%), according to the survey.

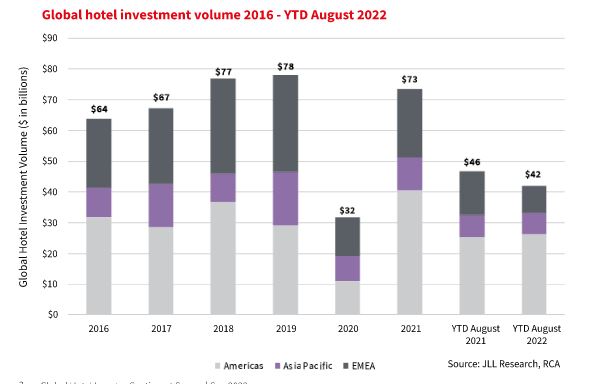

Global hotel investment in the year to August stood at $42 billion, a decline of 10% y-on-y. Predictably, the Americas region saw the lion’s share of investment, accounting for 60% of all investment, following the end to all testing and quarantine travel restrictions for both domes- tic and international visitors. Activity across the EMEA and APAC regions remained more subdued given ongoing COVID-19 related travel restrictions and Russia’s ongoing war with Ukraine.

In this year’s survey, London, Tokyo and Boston emerged as the top three markets for hotel investment, highlighting renewed investor interest in key markets. Over the next six months, 57% of those surveyed anticipate the best investment opportunities becoming available across more traditional hospitality property types, including full-service and select-service hotels. In addition, 82% of investors indicated that they are targeting value-add investment opportunities and 34% of investors are interested in vacant possession or unencumbered hotels.

Germany, however, has not fared as well. In the first half of 2022, investment in hotels fell by around a quarter year-on-year to around €755 million across 32 transactions, taking the German hotel investment market below the billion euro mark at the half-year point for the first time since 2013, according to JLL. The ten and five-year averages were also down by 44% and 49% respectively.

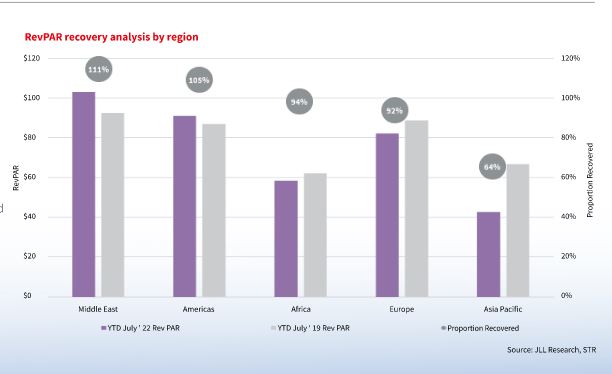

Although the pace of recovery will vary by region, hotel fundamentals are expected to continue to recover, albeit at a more protracted rate given global economic headwinds. Investor interest in the sector is expected toremain strong with transaction activity picking up in the medium term.

JLL’s Hotel Investor Sentiment Survey represents a compilation of more than 7,800 data points from hotel investors on future hotel operating performance expectations, yield requirements and future cap rate trends.

More consolidation on the cards? As fundamentals improve, we could see more consolidation in the sector. This week, Dutch hotel group Borealis Hotel Group acquired Wiesbaden-based hotel operator and developer Bierwirth & Kluth Hotel Management (B&K), which operates in the DACH region, for an undisclosed sum. At the same time, BHG announced that Atlantic Park Strategic Capital Fund, a joint venture between General Atlantic and Iron Park Capital Partners, has joined the shareholder structure alongside existing investor Three Hills Capital Partners and the company’s founders. B&K’s strong presence in the DACH region is a logical strategic addition to Borealis’ current international portfolio, with the complementary nature of the two portfolios creating a larger, pan-European player with a strong presence in the region.

‘This is an important milestone,’ said Bart van de Kamp, CEO and founder of Borealis Hotel Group. ‘We are grateful that Three Hills Capital Partners will continue to support us after they successfully navigated us through the Corona pandemic and, together with AP, continue to provide the resources and knowledge to continue our expansion and growth.’

B&K was founded in 1998 by Peter Bierwirth and Klaus Kluth and has since become one of the most successful white-label hotel operators in Germany, including franchise partnerships with leading brands such as Marriott and IHG. Borealis, for its part, operates a portfolio of economy, mid-scale, upscale and extended stay hotels in key European markets, partnering with major brands such as IHG, Hilton, Marriott, Accor and Hyatt. It is pursuing a pan-European expansion strategy, developing hotels across Europe and targeting strategic M&A opportunities as it continues to grow its portfolio. In 2019, Borealis welcomed Three Hills Capital Partners as an active financial partner to support the platform’s rapid expansion and leverage its extensive pipeline of opportunities.

There have been a few recent hotel deals in Germany, although the financial terms are often opaque. Recent deals include the acquisition of the A&O Hostel Berlin Hauptbahnhof by the hostel chain A&O, which has already leased the property with almost 1,000 beds since 2010 and will continue to operate it in the future. The purchase was financed by Deutsche Kreditbank (DKB). Radisson Blu Hotel Cottbus was also acquired by the previous operator RIMC Hotels & Resorts this summer for an undisclosed sum. Another notable sale was that of the recently reopened Meininger Hotel Bremen Hauptbahnhof as part of the mixed-use property Higheleven by developer Buhlmann Immobilien Gesellschaft. The property was purchased by the first closed-end special fund of Magna Asset Management and Hansainvest this summer for an undisclosed sum.

THPT Comment: The strong German slant comes from the fact that we picked up this post from German RE Finance – REFIRE. The report was compiled by nine JLL folks based in various European, US and Asia-Pac offices

First Seen: German Real Estate Finance – REFIRE

The Hotel Property Team (THPT) are a small group of highly experienced business professionals. Between us, we provide a range of skills and experience which is directly relevant to those involved in the hotel property market.

For more information – Visit www.thpt.co.uk or email info@thpt.co.uk